Real Estate Tax Exemption For Veterans In Pa . Pennsylvania real estate tax exemption for disabled veterans. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. Additional eligibility requirements and references may be found on their website. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Philadelphia veterans advisory commission is happy to provide you with this. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further.

from www.exemptform.com

Pennsylvania real estate tax exemption for disabled veterans. Philadelphia veterans advisory commission is happy to provide you with this. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Additional eligibility requirements and references may be found on their website.

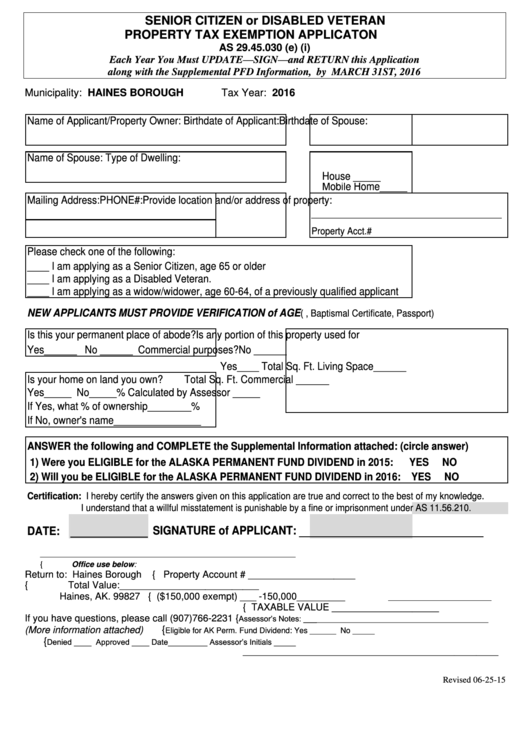

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Real Estate Tax Exemption For Veterans In Pa A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania real estate tax exemption for disabled veterans. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. Philadelphia veterans advisory commission is happy to provide you with this. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Additional eligibility requirements and references may be found on their website. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five.

From goredleg.com

Illinois Disabled Veterans Real Estate Tax Exemption Update and HB2507 Real Estate Tax Exemption For Veterans In Pa Philadelphia veterans advisory commission is happy to provide you with this. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. The real estate tax exemption program is for. Real Estate Tax Exemption For Veterans In Pa.

From www.exemptform.com

Tax Exemption Form For Veterans Real Estate Tax Exemption For Veterans In Pa An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. Pennsylvania real estate tax exemption for disabled veterans. Philadelphia veterans advisory commission is happy to provide you with this. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to. Real Estate Tax Exemption For Veterans In Pa.

From www.youtube.com

Disabled Veterans Qualify for Real Estate Tax Exemption YouTube Real Estate Tax Exemption For Veterans In Pa A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the. Real Estate Tax Exemption For Veterans In Pa.

From www.youtube.com

Texas Disabled Veteran Property Tax Exemption (EXPLAINED) YouTube Real Estate Tax Exemption For Veterans In Pa The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. Philadelphia veterans advisory commission is happy to provide you. Real Estate Tax Exemption For Veterans In Pa.

From mashaqjulina.pages.dev

2024 Estate Tax Exemption Irs Andra Blanche Real Estate Tax Exemption For Veterans In Pa Additional eligibility requirements and references may be found on their website. Philadelphia veterans advisory commission is happy to provide you with this. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Disabled veterans in pennsylvania can benefit. Real Estate Tax Exemption For Veterans In Pa.

From vaclaimsinsider.com

18 States With Full Property Tax Exemption for 100 Disabled Veterans Real Estate Tax Exemption For Veterans In Pa A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania real estate tax exemption for disabled veterans. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes,. Real Estate Tax Exemption For Veterans In Pa.

From joeannwdrusie.pages.dev

Gift Tax 2024 Exemption Application Lenka Mariana Real Estate Tax Exemption For Veterans In Pa A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania real estate tax exemption for disabled veterans. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary. Real Estate Tax Exemption For Veterans In Pa.

From sanjaytaxprozzz.blogspot.com

Philadelphia Transfer Tax Exemption Real Estate Tax Exemption For Veterans In Pa Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program.. Real Estate Tax Exemption For Veterans In Pa.

From www.exemptform.com

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download Real Estate Tax Exemption For Veterans In Pa Additional eligibility requirements and references may be found on their website. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them. Real Estate Tax Exemption For Veterans In Pa.

From www.exemptform.com

Veteran Tax Exemption Submission Form Real Estate Tax Exemption For Veterans In Pa A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Philadelphia veterans advisory commission is happy to provide you with this. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. Pennsylvania real estate tax exemption for disabled veterans.. Real Estate Tax Exemption For Veterans In Pa.

From www.exemptform.com

Tax Exemption Form For Veterans Real Estate Tax Exemption For Veterans In Pa Philadelphia veterans advisory commission is happy to provide you with this. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania real estate tax exemption for disabled veterans. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. An. Real Estate Tax Exemption For Veterans In Pa.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Real Estate Tax Exemption For Veterans In Pa Additional eligibility requirements and references may be found on their website. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. Philadelphia veterans advisory commission is happy to provide you with. Real Estate Tax Exemption For Veterans In Pa.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Real Estate Tax Exemption For Veterans In Pa Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. Disabled veterans in pennsylvania can benefit from a. Real Estate Tax Exemption For Veterans In Pa.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Real Estate Tax Exemption For Veterans In Pa An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Disabled veterans in pennsylvania can benefit from a property tax exemption on their primary residence, providing them with reduced.. Real Estate Tax Exemption For Veterans In Pa.

From www.dochub.com

Form 136 indiana Fill out & sign online DocHub Real Estate Tax Exemption For Veterans In Pa The real estate tax exemption program is for wartime veterans that are 100% disabled, and this program requires the claimant to already own the property and it must be their primary domicile. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further. Disabled veterans in pennsylvania can benefit from a. Real Estate Tax Exemption For Veterans In Pa.

From www.formsbank.com

Property Tax Exemption Application For Qualifying Disabled Veterans Real Estate Tax Exemption For Veterans In Pa Additional eligibility requirements and references may be found on their website. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Philadelphia veterans advisory commission is happy to provide you with this. An act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate. Real Estate Tax Exemption For Veterans In Pa.

From www.exemptform.com

Clarion County Pa Property Tax Exemption Form Real Estate Tax Exemption For Veterans In Pa Pennsylvania real estate tax exemption for disabled veterans. Philadelphia veterans advisory commission is happy to provide you with this. Additional eligibility requirements and references may be found on their website. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. The real estate tax exemption program is for wartime. Real Estate Tax Exemption For Veterans In Pa.

From www.pinterest.com

Pin by Diane Dries, Realtor, Artist on WEB GUIDE HOME BUYERS Estate Real Estate Tax Exemption For Veterans In Pa Pennsylvania real estate tax exemption for disabled veterans. A new state law excluding all veterans’ benefits from the income assessment in the disabled veterans’ real estate tax exemption program. Pennsylvania shall be exempt from the payment of all real estate taxes levied upon any building, including up to five. An act amending title 51 (military affairs) of the pennsylvania consolidated. Real Estate Tax Exemption For Veterans In Pa.